New 30-Year Amortization for First-Time Buyers: What You Need to Know

Who Qualifies for the New 30-Year Option?

As a mortgage broker based in Langley, BC and serving all of British Columbia, I often work with first-time home buyers who are navigating mortgage options for the first time. One of the biggest challenges today is affordability. That’s why a recent rule change regarding 30-year amortizations is worth paying close attention to.

In this article, I’ll walk you through what’s changed, who qualifies, how it compares to a conventional mortgage, and what it could mean for your monthly budget. Whether you’re just starting to look at homes or getting ready to apply for a mortgage, this guide will help you understand your options clearly.

What Is an Amortization Period?

The amortization period is the total length of time it will take to pay off your entire mortgage. In Canada, the most common amortization periods are 25 or 30 years. A longer amortization means smaller monthly payments—but more interest paid over the life of the loan. Shorter amortizations result in higher payments, but less total interest.

It’s important to note that the amortization is different from your mortgage term. The term is the length of time you commit to a lender, interest rate, and conditions (usually 1 to 5 years).

What Changed in 2025 for First-Time Buyers?

In 2025, the federal government introduced a new rule allowing qualifying first-time home buyers to access a 30-year amortization on insured mortgages. Prior to this, insured mortgages were capped at 25 years.

This rule was implemented to improve affordability by reducing monthly payments for those trying to enter the housing market.

According to the Department of Finance Canada, the goal is to provide more flexibility to first-time buyers without significantly increasing overall risk to the financial system.

Who Qualifies as a First-Time Home Buyer?

To be considered a first-time home buyer under this new rule, at least one borrower on the mortgage must meet one of the following:

-Never purchased a home before

-Has not occupied a home (owned by self or spouse/common-law partner) in the last 4 years

-Recently experienced a breakdown of a marriage or common-law relationship, and has lived apart for at least 90 days

-The property must also be owner-occupied or intended for immediate family (like a child or parent), and the down payment must be less than 20% to qualify as an insured mortgage.

For more details on insured mortgage qualification criteria, visit the CMHC Mortgage Loan Insurance page.

How Insured Mortgages Work

When you put down less than 20% on a home purchase in Canada, your mortgage must be insured through a provider like CMHC, Sagen, or Canada Guaranty. This insurance protects the lender—not you—in case you default.

The insurance premium is added to your mortgage and varies based on your down payment. For a 10% down payment, the base premium is 3.10% of the loan amount. With the 30-year amortization option, there's a 0.20% surcharge, bringing the total premium to 3.30%.

Insured vs Uninsured Mortgages: What’s the Difference?

An insured mortgage is one with less than 20% down and requires default insurance. An uninsured mortgage (also called conventional) is when you put 20% or more down.

Here’s the surprising part: insured mortgages often receive lower interest rates. That’s because the lender is protected from losses, which reduces their risk.

With an uninsured mortgage, there’s no protection for the lender. So even though you're putting more money down, lenders may offer slightly higher rates to compensate.

Real-World Comparison: 10% Down vs 20% Down

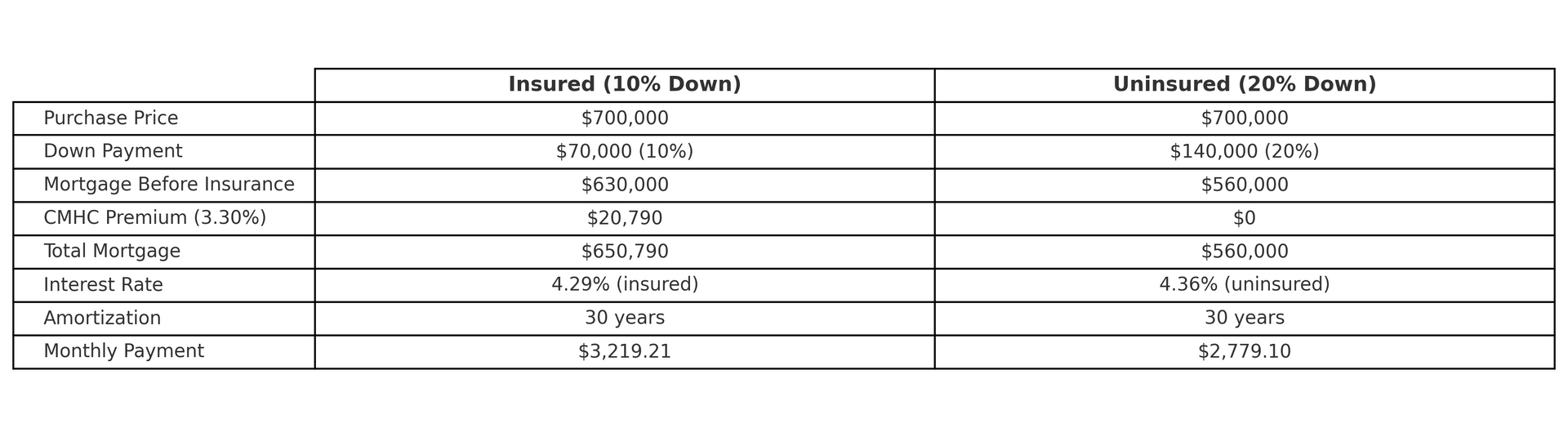

Let’s look at a $700,000 purchase price, with one buyer putting 10% down (insured mortgage) and the other putting 20% down (uninsured). Both take a 30-year amortization.

You can see the full breakdown in the chart at the top. The first question is, do you have the resources to put 20% down. Pay particular attention to the CMHC one time premium cost to access an insured mortgage option. It's a cost you have to consider when comparing the interest rates difference between the two products.

Can I make prepayments?

Yes, depending on the lender, you can usually make lump-sum payments or increase monthly payments without penalty.

Do all lenders offer this option?

Most major banks and mortgage lenders offer it, but policies may vary. A broker can compare the best options for you.

How a Mortgage Broker Can Help

As a licensed mortgage broker in Langley, BC (and working with clients all over the province), I help first-time buyers:

-Confirm whether they qualify for this new 30-year option

-Compare rates between insured and uninsured lenders

-Understand the total cost of borrowing

-Navigate lender rules and paperwork

I simplify the process so you can focus on what matters: finding the right home.

Final Thoughts: Is the 30-Year Option Right for You?

This new rule is a welcome change for many British Columbians trying to buy their first home. It won’t be right for everyone, but it offers a new path for those with good credit, stable income, and a smaller down payment.

If you're wondering whether this applies to you, I’d be happy to walk through the numbers and show you what it would look like in your situation.

There’s no cost to talk—just professional, honest advice to help you make a confident decision.

Want to learn more about first-time buyer programs in BC? Check out the

BC Government’s Homebuyer Resources.