Will Interest Rates Go Up in 2022?

Just how High Can It Go?

Fixed mortgage rates have increased between .50% to .60% over the short term. This is due to the Bank of Canada ending quantitative easing (QE). QE was a stimulus program that introduced at the start of the pandemic to pump money into the economy. What it also did was lower the bond prices and by extension the fixed mortgage rates. When they stopped QE, bond market yields went up which in turn raised the fixed mortgage rates.

The Bank of Canada acted to calm the fears of the market. With signs of the economy recovering, we in turn run the risk of inflation getting out of control. But some experts think it's too early to assume we are in full recovery.

Scotiabank predicted eight quarter-point interest rate hikes (or 2%) by the end of 2023. That made huge headlines, and likely they saw a large number of clients locking in. Analyst, Ben Rabidoux, says that the fear of rate hikes is overblown, and that eight hikes is a “pipe dream.” The other Canadian big banks expect only between one and three rate hikes by the end of 2023.

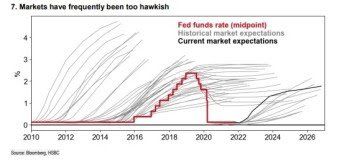

Take a look at the above interest rate graph. The light grey lines show the "expert" predictions and the red line shows the actual increases. Predictions were much more aggressive than what actually happened. We likely will see a very similar outcome, considering that Canadians are risk-sensitive.

Bank of Canada's interest rate increases would impact all variable mortgage rates. The result is that your variable rate mortgage monthly payment will increase. Every 0.25% increase would equal about $13 per month for every $100K owing on your mortgage. A $500K mortgage would increase by approximately $65/month. (Check your MOPOLO mobile app to get exact numbers for your mortgage).

Locking into a fixed rate is a personal decision and should based on more than predictions. Today's variable rates still offer attractive discounts. They also feature much lower prepayment penalties than fixed rates do. By choosing a mortgage based on the interest rate alone, you could end up paying far more than you bargined for. To save money over the life of your mortgage you have to look at the features and benefits.

As for a rate increases in 2022, we will have to see what actually happens. Our dynamic market changes almost daily making it more difficult to decide what to do. Yet, even if the prime rate go up another .25% or .50%, a variable term is still a great option with today's large discount.

The best advice I can give is to work with an independent mortgage expert. We can provide options you may not be aware of, so that you can make the right decision for your circumstances. Furthermore, we can help you make a plan for what you will do if rates go up quickly. Know your numbers and where your line in the sand will be to lock in a variable rate into a fixed term, if you need to. This decision should never be a knee jerk reaction, but thought out in advance so you can sleep through all the media noise.

Book a consultation here if you need help with your mortgage.